32+ arkansas payroll tax calculator

No more surprise fees from other payroll providers. EzPaycheck Calculate Tax Print check W2 W3 940 941 Free Trial.

Solved Extra 4 3 Develop The Income Tax Calculator In This Chegg Com

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

. Web Arkansas Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal. Web Arkansas AR State Payroll Taxes Now that weve gone through federal payroll taxes lets look at Arkansas state income taxes. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

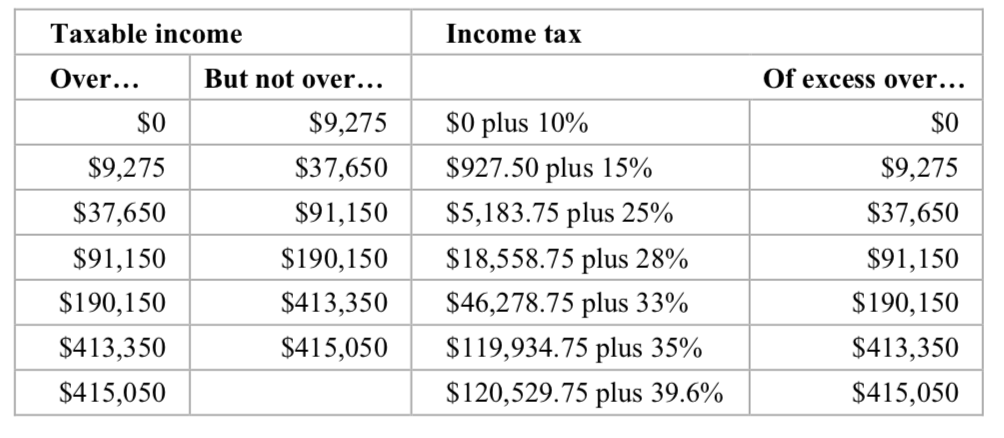

Web The state income tax rate in Arkansas is progressive and ranges from 0 to 55 while federal income tax rates range from 10 to 37 depending on your income. 10 12 22 24 32 35 or 37. Let us know your questions.

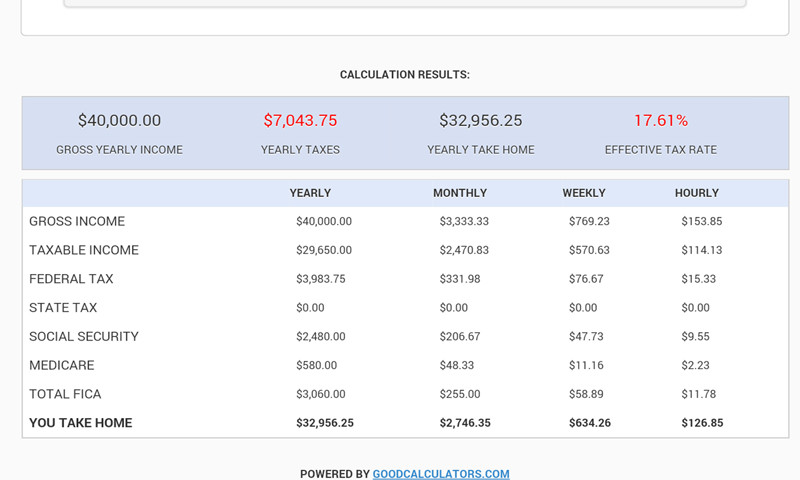

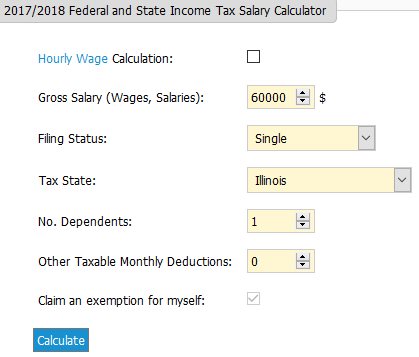

Web Paycheck Calculator Arkansas. Web The Arkansas Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Paycheck calculators are great tools to have available in.

Free Unbiased Reviews Top Picks. Web You are able to use our Arkansas State Tax Calculator to calculate your total tax costs in the tax year 202223. Web 10 12 22 24 32 35 or 37.

If this employees pay frequency is weekly the calculation is. Ad Takes 2-5 minutes. Web Arkansas Income Tax Calculator 2022-2023 If you make 70000 a year living in Arkansas you will be taxed 11683.

Get honest pricing with Gusto. In 2023 the tax rates ranged. Your average tax rate is 1167 and your marginal.

Using A Paycheck Calculator To Calculate Your Income Tax Payment. Get 3 Months Free Payroll. Compare options to stop garnishment as soon as possible.

Ad Compare This Years Top 5 Free Payroll Software. Web Arkansas Paycheck Calculator Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Ad Get full-service payroll automatic tax calculations and compliance help with Gusto.

Supports hourly salary income and. Our calculator has recently been updated to include both the latest. Web Use our free Arkansas paycheck calculatorto determine your net payor take-home pay by inputting your period or annual income along with the necessary federal.

Just enter the wages tax. A stabilization rate that changes each year is added to come up with your total tax rate. Again the percentage chosen is based on the paycheck amount and your W4 answers.

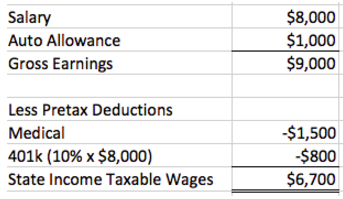

Web minus any tax liability deductions withholdings Net income Income tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck. Make The Switch To ADP. The State of Arkansas levies a progressive tax rate which means the tax increases with a higher income.

All Services Backed by Tax Guarantee. Web Rates for Arkansas unemployment tax vary and range between 01 to 50. Estimate garnishment per pay period.

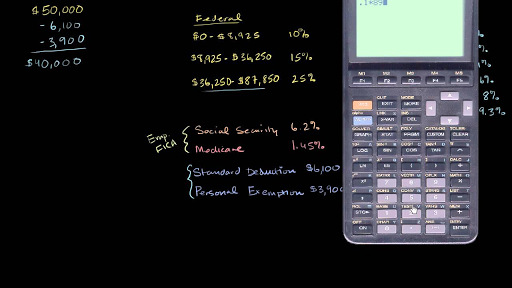

Web Arkansas Paycheck Calculator Use ADPs Arkansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Web First you must know the income tax rates.

Web For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount. All-In-One Payroll Solutions Designed To Help Your Company Grow. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

The state charges a. State and local W4 information into this. Ad Fast Easy Affordable Small Business Payroll By ADP.

Ad Payroll So Easy You Can Set It Up Run It Yourself.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

United States Salary Tax Calculator For Android Free Download

Obesity In Children And Young People A Crisis In Public Health Lobstein 2004 Obesity Reviews Wiley Online Library

Bonus Pay How To Calculate Work Bonuses And Tax In 2023

Federal And Arkansas Paycheck Withholding Calculator

Us Salary Tax Calculator By Andrew Stacy Android Apps Appagg

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Arkansas Paycheck Calculator Tax Year 2022

Paycheck Calculator Take Home Pay Calculator

5 Free Salary Calculator Websites With State Tax Calculations

14205 Goldfinch Rd Neosho Mo 64850 Mls 225771 Zillow

Blazing New Trails Connexions

How Are Payroll Taxes Calculated State Income Taxes Workest

Request For Proposal Rfp For Competitive Projects July 1 2014 To June 30 2015 Ppt Download

Payroll Tax Calculator Screen

Obesity In Children And Young People A Crisis In Public Health Lobstein 2004 Obesity Reviews Wiley Online Library

Calameo Russian Denver N1 782